Our Monthly Market update is a week late (oops!) but the good news is that the stats about December haven’t changed since last Monday! The commercial real estate market as a whole isn’t expected to rebound fully for a good long while, but there are sectors that have been surviving – even thriving – through the last 10 months!

The per square foot price of office sales plummeted at the end of the year with office space selling for nearly half that of the previous month. Even year-over-year we’re looking at an average sales price in December 2020 that was 49% lower than December 2019.

Industrial properties continued to see strong numbers with both average lease rate and average sale rate (per square foot) increasing by 159% and 116% respectfully.

Surprisingly retail lease rates held only, only decreases 8% from the previous month, while the sale price actually increased from the November by 112%. If we look back at November 2019, though, the average lease rate is up slightly (from $13.32 PSF to $13.58 PSF) AND the average reported sale rate is up slightly (from $81.36 PSF to $85.72 PSF).

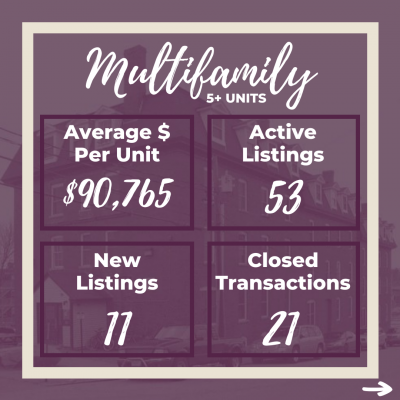

Ending 2020, we saw an increase in the per-unit price of multi-families and 8 of the 21 sold properties were on the market for less than 10 days, enforcing the narrative that this is the golden age of multi-families.

0 Comments